irs tax levy program

The earlier you hire an accountant the easier it is to defend you during your audit rather than waiting for the IRS threaten to levy or collect on the tax debt. The IRS provides a 21-day waiting period to allow you time to arrange to pay your tax debt or inform the agency of levy errors.

Tax Levy Or Irs Wage Garnishment Irs Levy Or Bank Levy

The Federal Payment Levy Program is an automated levy program the IRS has implemented with the Department of the Treasury Bureau of the Fiscal Service since 2000.

. What is an IRS Levy. Ad Use our tax forgiveness calculator to estimate potential relief available. Ad Honest Fast Help - A BBB Rated.

Because federal payments such as Social Security constitute a significant portion of many taxpayers monthly income TAS published a Consumer Tax Tips brochure What You. No Fee Unless We Can Help. Review Comes With No Obligation.

IRS will send you a notice prior to levying the. Trusted Reliable Experts. Tax Relief up to 96 See if You Qualify For Free.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Ad Our Tax Relief Experts Have Resolved Billions in Tax Debt. BEFORE any of your assets can be taken the IRS must issue you a Final Notice of Intent to Levy.

You May Qualify For An IRS Hardship Program If You Live In New Jersey. Ad BBB Accredited A Rating. End Your IRS Tax Problems - Free Consult.

If you have not received this notice then a levy is not in place yet. Take Avantage of Fresh Start Options Available. What to bring to your.

End Your IRS Tax Problems Today. Ad We Provide Helpful Honest Information To Match You With Companies That Best Suits You. They will assess your full financial picture to determine eligibility.

This means that the IRS or state tax agency agrees to settle your tax debt for less than the full amount you owe. Click Now Find the Best Company for You. End Your IRS Tax Problems - Free Consult.

Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. Ad We Can Solve Any Tax Problem. Affordable Reliable Services.

When taxpayers do not pay delinquent taxes the Internal Revenue Service IRS can work directly with financial institutions and other third parties to seize the taxpayers. IRS Tax Refund Levy. If you have received this notice.

Ad BBB Accredited A Rating. Get Your Free Tax Review. This program matches federal tax delinquent accounts against a database of Alaskan residents eligible to receive the dividend.

Ad Remove IRS State Tax Levies. 100 Money Back Guarantee.

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block

5 11 7 Automated Levy Programs Internal Revenue Service

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

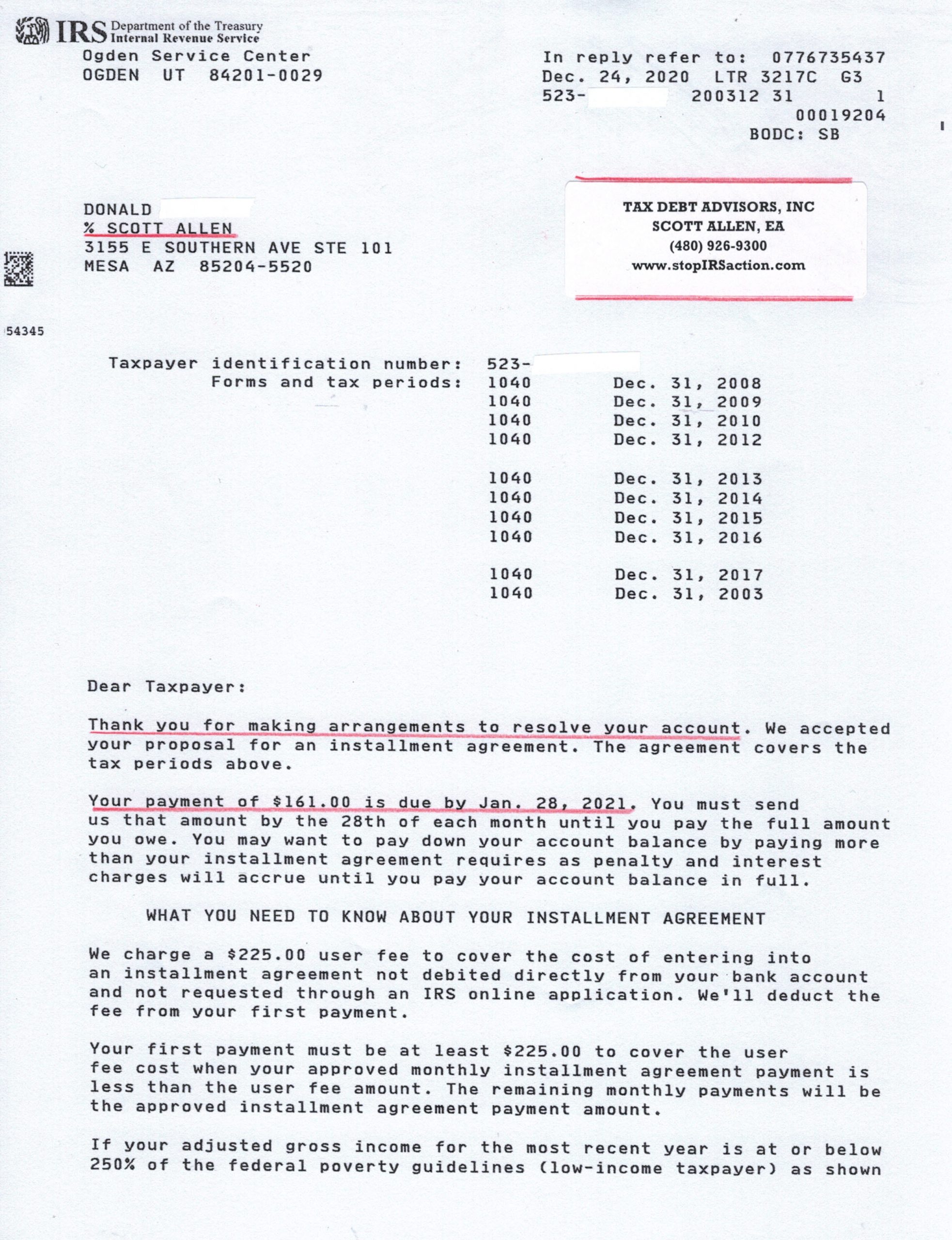

Tax Bankruptcy Tax Debt Advisors

Hiding Assets To Thwart Irs Tax Collection Can Be Criminal

Irs Just Sent Me A Notice Of Intent To Seize Levy Your Property Or Right To Property Cp 504 What Should I Do Legacy Tax Resolution Services

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Audit Letter Cp504 Sample 1

Irs Has Restarted The Income Tax Levy Program

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Bank Levy Tax Center Usa Tax Problem Relief

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Tax Levy Tax Law Offices Of David W Klasing